Calculate my sales tax

State and local governments across the United States use a sales tax to pay for things like roads healthcare and other government services. Sales and Use Tax.

Our Platform Taxjar

You live in Natrona County 5 sales tax Trade allowance is 10000 30000- 10000 20000 Sales tax for vehicle is 5 of 20000 which 1000.

. You live in Natrona County 5 sales tax With Trade. Calculate the current years permanent differences. At a glance calculating sales tax seems simple.

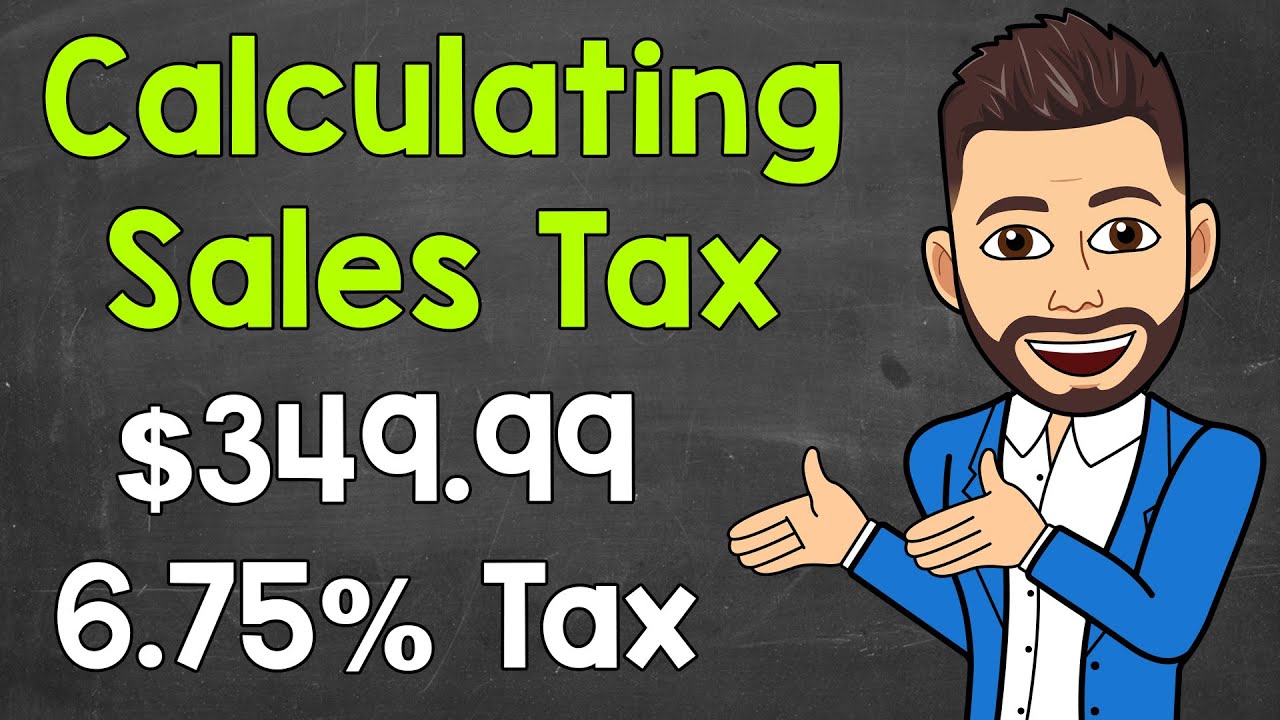

Once you know the sales tax rate you need to collect at use the sales tax formula. Consolidate your net tax Rebate under Sec 87A. How much VAT are you paying on your sales or purchases.

Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. Retail Sales Tax on Accommodations. How much would it cost to import a bike when you include import duty excise tax and custom clearance fees.

The real trick is figuring out what needs to. Pay As You Earn PAYE Motor Vehicle Import Duty. Registration Fees County Fee.

How is sales tax calculated. This is your income as calculated by GAAP rules before income taxes. With sales tax though its almost never that easy.

Arizona has a state sales tax of 56 Maricopa County has a county sales tax rate of 07 and Scottsdale has a city sales tax rate of 175 2022. The following steps outline how you calculate current income tax provision. Know the basic California sales tax rate.

Relying on a city or ZIP code is not a reliable way to calculate sales tax rates. The starting point for calculating sales tax is the statewide rate of 75 percent. This figure is a little more complex.

Start with your companys net income. Take the price of a taxable product or service and multiply it by the sales tax rate. Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit.

Its always better to learn about them before a deal is final. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation districts. Peer-to-Peer Vehicle Sharing Tax.

This rate is standard across California and is the lowest sales tax rate a seller or consumer can pay. While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels. For example if the sales tax rate is 6 divide the total amount of receipts by 106.

The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted. Vehicle Factory cost is 30000. Weve been taking the time-suck headache and anxiety off the table for businesses for the last 23 years Step away from the sales tax avoid the hazards and intricacies and put both hands back on what you do best your day job Put your sales tax on auto-pilot and.

Accelerated Sales Tax Payment. The total amount paid in taxes in 2021 and your taxable income in the same year. The jurisdiction breakdown shows the different sales tax rates making up the combined rate.

Legal Secrets to Reducing Your Taxes. Motor Vehicle Rental Tax. To calculate your effective tax rate you need two numbers.

Use our calculator below to find out. How to File and Pay Sales Tax. Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in California from a licensed California dealer Registration fees for new resident vehicles registered outside the state of California Registration fees for used vehicles that will be purchased in California.

The sales tax formula is used to determine how much businesses need to charge customers based on taxes in their area. Get the Right Figure. Better things happen when you step away from the complexity of sales tax and hand it over to the proven professionals.

Remote Sellers Marketplace Facilitators. Motor Cycle Import Duty. Sales Tax Rate Lookup.

An out-the-door price quote will reveal any hidden fees or extras in the contract including taxes title and registration. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. Sales tax applies to most consumer product purchases and exists in most states.

255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. These are income items or expenses that are not allowed for income tax purposes but that are allowed for GAAP.

In case your total taxable income after deductions doesnt exceed Rs 5 lakh you can claim rebate under Sec 87A of Rs 12500.

Sales Tax Calculator

Sales Tax Calculator Taxjar

How To Calculate Sales Tax In Excel

Sales Tax Calculator Taxjar

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax In Excel

Sales Tax Definition How It Works How To Calculate It Bankrate

How To Calculate Sales Tax Without A Calculator Calculating Sales Tax By Hand Math With Mr J Youtube

What Is Sales Tax Nexus Learn All About Nexus

Sales Tax Api Taxjar

How To Calculate Sales Tax In Excel

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculator Taxjar

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Sales Tax Calculator

How To Calculate Sales Tax Math With Mr J Youtube